Condo Insurance in and around Seattle

Condo unitowners of Seattle, State Farm has you covered.

Protect your condo the smart way

Home Is Where Your Condo Is

The life you are building is rooted in the condo you call home. Your condo is where you relax, unwind and laugh and play. It’s where you build a life with your favorite people.

Condo unitowners of Seattle, State Farm has you covered.

Protect your condo the smart way

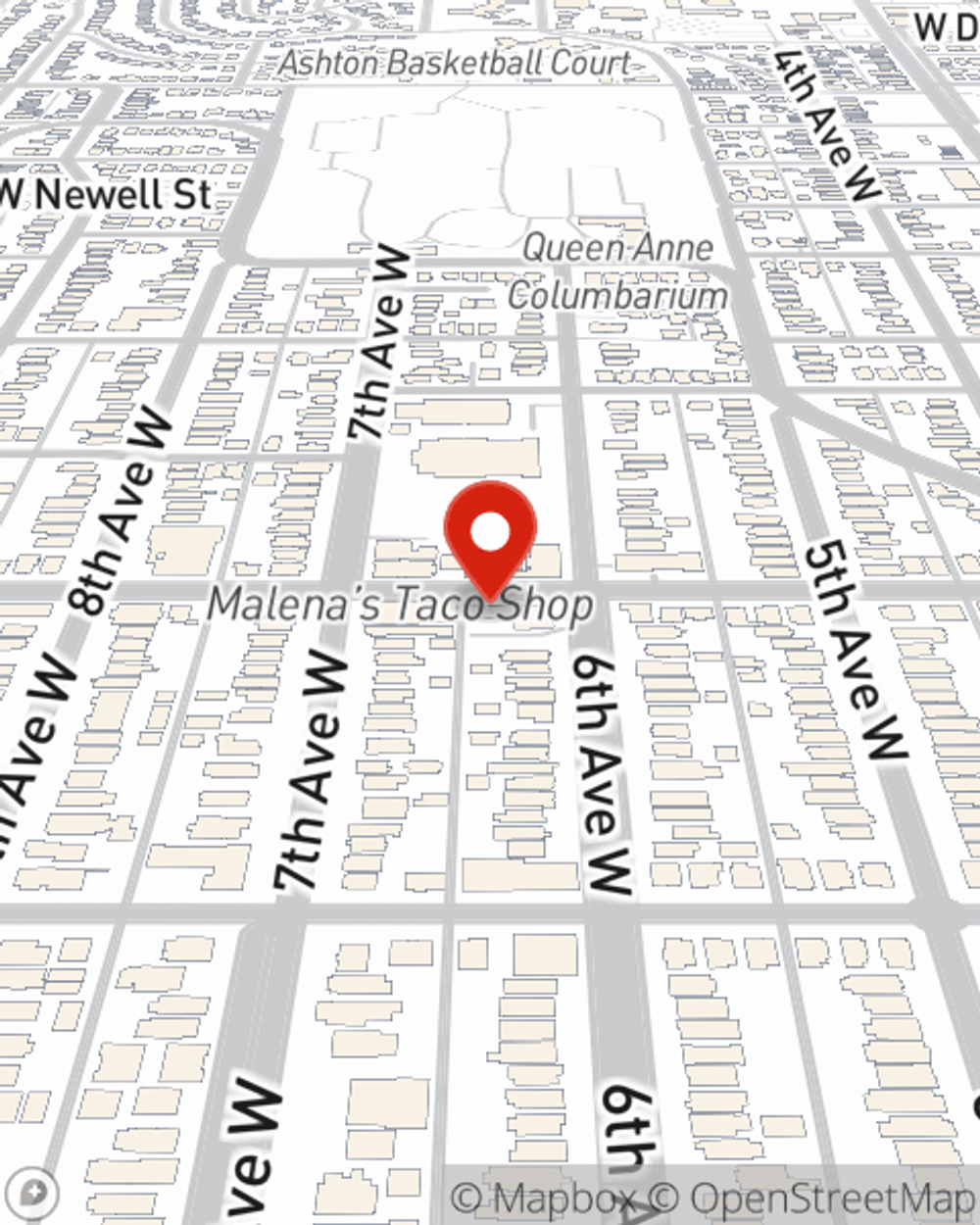

Agent Chuck Mcfarland, At Your Service

You want to protect that significant place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as vandalism, lightning or weight of ice or snow. Agent Chuck McFarland can help you figure out how much of this wonderful coverage you need and create a policy that has what you need.

Don’t let the unknown about your condo make you unsettled! Visit State Farm Agent Chuck McFarland today and see how you can save with State Farm Condominium Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Chuck at (206) 788-4640 or visit our FAQ page.

Simple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Chuck McFarland

State Farm® Insurance AgentSimple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.